The sudden crash of Bitcoin (BTC) on Jan. 10 saw the price trade below $40,000 for the first time in 110 days and this was a wake-up call for leveraged traders. $1.9 billion worth of long (buy) futures contracts were liquidated that week, sending trader morale plummeting.

The “crypto Fear & Greed” index, which ranges from 0 for “extreme fear” to 100 for “greed”, reached 10 on January 10, the lowest level since the crash of March 2020. The indicator measures the Trader sentiment using historical volatility, market momentum, volume, Bitcoin dominance, and social media.

As usual, the panic turned into a buying opportunity as the total cryptocurrency market capitalization surged 13.5%, going from a low of $1.85 trillion to $2.1 trillion in less than three days.

Currently, investors appear to be digesting this week’s economic data showing that US retail sales in December 2021 were down 1.9% compared to the previous month.

Investors have reason to worry about stagflation, a scenario in which inflation accelerates despite a lack of economic growth. However, even if Bitcoin’s digital scarcity is eventually shown to be a positive feature, markets will continue to take refuge in whatever asset is deemed safe. Thus, the first wave will be potentially detrimental to cryptocurrencies.

Bitcoin price was flat for the past seven days, underperforming the altcoin market’s 7% gain. Part of this unusual movement can be explained by layer 1 decentralized application platforms showing positive performance that was driven by Fantom (FTM), Cardano (ADA), Near Protocol (NEAR), and Harmony (ONE).

Loopring (LRC), an open protocol from zkRollup for decentralized exchanges on Ethereum, posted the worst performance of the week. The volume of DEXs using the protocol peaked at $30 million a day in early December 2021 but is now close to $6 million. Meanwhile, Dfinity (ICP) and Chainlink (LINK) are adjusting after a rally of 40% or more in the first 10 days of 2022.

Tether premium and futures premium held up well

The Tether premium or discount (USDT) on OKEx measures the difference between Chinese peer-to-peer (P2P) trading and the official US dollar. Figures above 100% indicate excessive demand for investment in cryptocurrencies. On the other hand, a 5% discount usually indicates a lot of selling activity.

The Tether gauge bottomed out at a 3% discount on Dec 31, which is slightly bearish, but not alarming. However, this metric has held a decent 2% discount over the past week, indicating no panic selling by China-based traders.

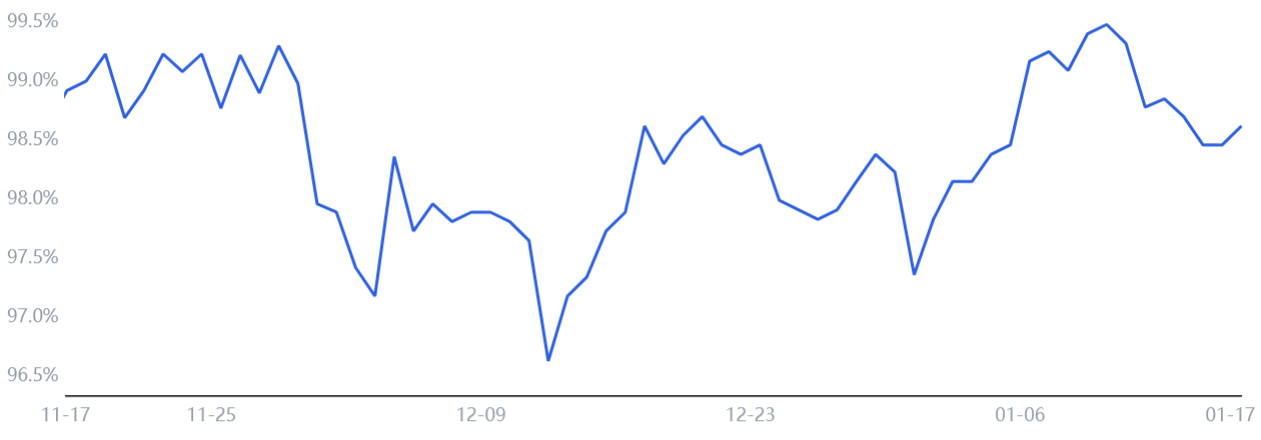

To further verify that the crypto market structure has held up, traders should look at the CME Bitcoin futures contract premium. That metric looks at the difference between long-term futures contracts and the current spot price in regular markets.

When this indicator disappears or turns negative, it’s a red flag for concern. This situation is also known as backwardation and indicates that bearish sentiment is present.

These fixed-month contracts typically trade at a slight premium, indicating that sellers are asking for more money to retain settlements longer. Consequently, futures should trade at a premium of between 0.5% and 2% in healthy markets, a situation known as contango.

Notice how the indicator turned negative on Dec. 9 when Bitcoin traded below $49,000, but still managed to maintain a slightly positive number. This shows that institutional traders are showing a lack of confidence, although it is not yet a bearish structure.

Considering that the total cryptocurrency market capitalization is down 9.5% YTD, the market structure has held up pretty well. The CME futures premium would have been negative if there had been excessive demand from short sellers.

Unless these fundamentals change significantly, there is not yet enough data available to support calls for a Bitcoin price below $40,000.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Cointelegraph. All investment and commercial movement involve risk. You should do your research when making a decision.