The Ibex tourism sector continues to show good prospects and general progress, which even places the stocks among the best of the year, as in the case of Melia Hotels or IAG (Iberia) within the Ibex. And it is mainly the incidence of Covid is what has marked its recovery patternwhich has been delayed by the arrival of omicron and the sixth wave, now clearly in remission throughout the world.

In fact, the prospects for tourist values are better and are also reflected in its annual march on the Ibex. The lifting of all restrictions in the UK and progressively in all countriesencourages the sector, which is regaining strength, especially due to the increase in international movements.

Thus we see how, despite the strong impact it has on the stock markets Russia’s decision to recognize the Donetsk and Luhansk republics with troops from the country on ukrainian territory has raised international tensions and risk aversionwhich makes it extremely difficult, with a new stone on the road, the recovery of a sector that presents good prospects as we will now see.

In fact, in terms of its price, we see that, despite the negative geostrategic effect, which is mainly due to the high volatility with which the market moves, Meliá Hotels, consolidating 7 euros per share, advances above 20.2% and is positioned as the best value in the sector so far this year, while IAG up 14.7% in the Ibex. Both are also placed in the Top5, fourth and fifth respectively. WhileAena advances above 5% in the market while Amadeus turns around, after yesterday’s session and advances 3% so far in 2022.

Waiting for how the market evolves, the truth is that its prospects, with the support of analysts, there is no doubt, especially in the case of IAGdespite the expected loss of value in its results. Morgan Stanley places its PO at 2.5 euros per sharewith an average price of Bloomberg at 2.37, while Bank of Americaafter its change of strategy in the star sectors this year, He clearly bets on the airlines.

Similarly it happens withn Meliá Hotels, which has the direct support of IG, like Amadeus and Aena, in a year that they hope will be one of recovery for the sector. In the specific case of Meliá Hotels, the latest accolade comes from Deutsche Bank that raises its target price, with purchase advice to 8.5 euros per share, which gives you a potential higher than 17%. In fact, the company already expects a V-shaped recovery with the forecast of reaching pre-Covid levels again at Easter.

As to the outlook for the sector remains favorable with the permission of the crisis in Ukraine, the consequences of which are still unknown. What was seen on Tuesday, from the lows of the Ibex to cuts of only half a point, shows the situation of instability in the markets. Globally, the report of the World Travel and Tourism Council places the sector with 7.6 billion euros of tourism contribution to global GDP, only 6.4% below pre-pandemic levels, which are expected to recover next year.

In the specific case of Spain, where we are one of the world leaders, the report highlights that the contribution of tourism to GDP could rise to 152,000 million euros in 2022, 14.4% below the levels prior to the pandemic crisis, although it must be remembered that we started at record levels of both revenue and visitors in 2019.

With a very positive recovery in employment levels, of 7.1% Compared to pre-Covid levels, meanwhile, let us remember, the services sector is the pre-eminent one in Spain in creating jobs.

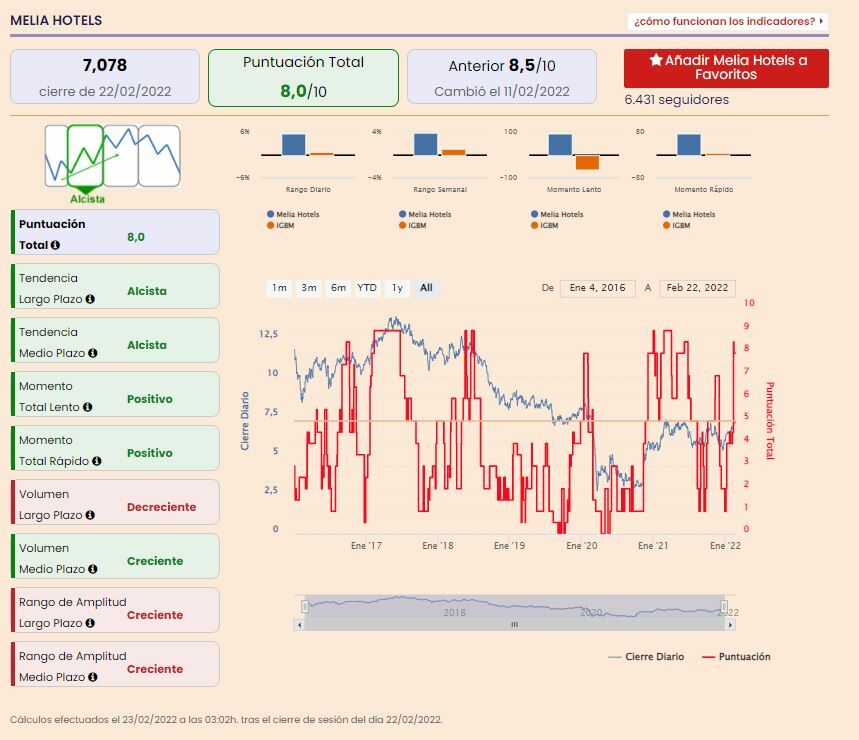

Regarding its premium indicators, those prepared by Investment Strategies, we see that the best technical note is presented for Meliá Hotels, with 8 points out of 10 possiblefollowed by the 7.5 points that Aena holds, with 7 also moving Amadeus and down to 5 out of 10 total score revised down for IAG.

Meliá Hotels only shows negative volume of business in the medium term and volatility, which, in its two aspects, is negative, increasing for the value. In the case of Aena, the volume of business in the medium and long term is decreasing and also the range of amplitude, as in the case of Meliá Hotels, is growing in both aspects.

If we look at Amadeus, its weakest points coincide with those of Aena: turnover and volatility which move respectively decreasing and increasing. IAG presents more obstacles, whose trend is long-term bearish, the total slow moment is negative and, as in the rest, volatility is marked negative, growing in the medium and long term.

The common denominator of all securities is their medium-term upward trend, which is also long in the case of Meliá Hotels, Aena and Amadeus.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.