It is obvious to any investor that the Big Tech are not right now, by far, the best sector of the market. All are shown to a greater or lesser extent on the downside in a Wall Street attacked by the elements and undoubtedly marked by volatility. Not to mention a Nasdaq, based on innovation in which approximately 50% of its values refer directly to technology companies.

It is not the best environment to expand, but in many cases, what analysts see, in its future progression, for a market that has also become clearly selective, that of technologies, with values to recommend, but others, that they do not even contemplate in their portfolios.

If you want to opt for the Big Tech there are two obvious things right now: their prices have been corrected in the last month to a greater extent generally and their prices are more attractivewhich is added to the generalization, although not always, of the improvement in its target prices and its upward path, let us always remember, one year ahead.

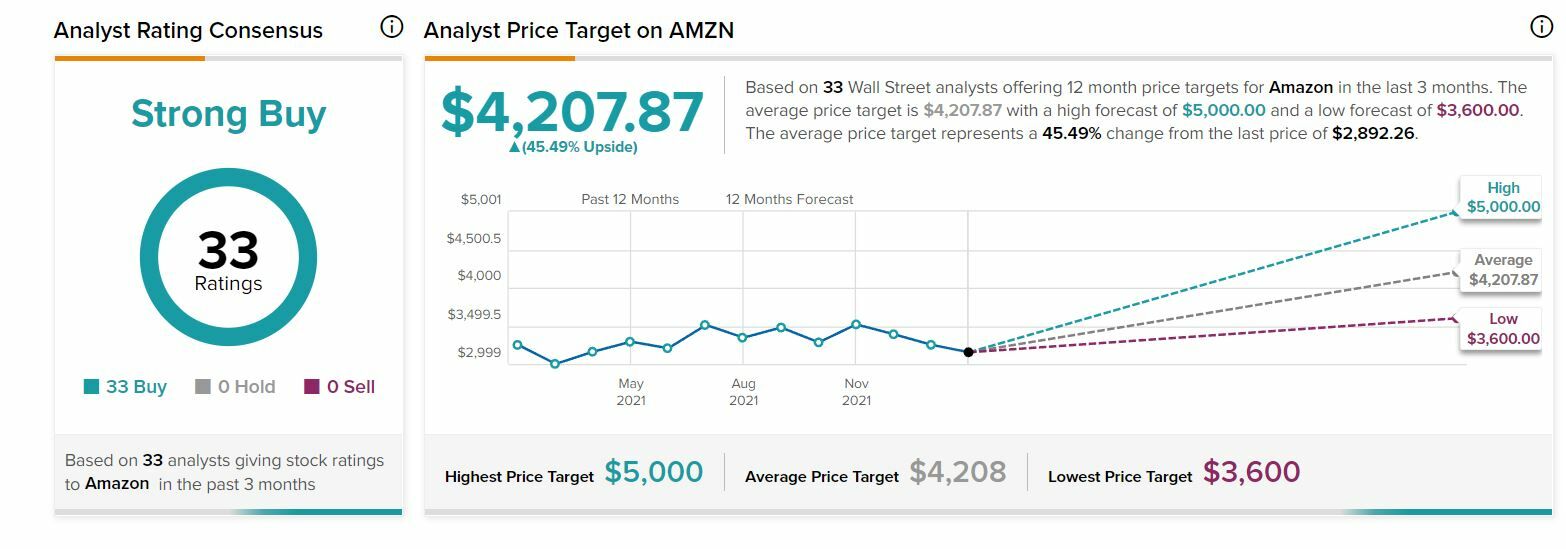

Amazon is a clear example of this. If just a month ago its target price was around $4,151, right now, the market average collected by TipRanks places its PO at 4207, with a potential rise of 45.5%. And with full purchase recommendations: of the 33 analysts who follow the value in the market, all 33 recommend buying their titles on the market.

Quite the opposite occurs in the case of Meta (Facebook), in which the analysts change their bias in many of the cases. Despite the fact that, of the 44 analysts consulted, a great majority, up to 32, choose to buy their shares, the truth is that up to 11 choose to maintain and one to sell. And, above all, the target price of the security is drastically reduced in one month: moves to $332.14 from previous $407.75 per share. Despite this, its falls in the market They raise the possible upward path for their shares to 69.27%.

We return to the positive and improved view from a month ago for Google, Alphabet-A in the market. In this case, there is unanimity of buying advice: of the 31 American market experts who cover the value and collected by Tipranks, all of them bet on their purchase in the market. And it beats the average market price by just over $100 its potential progression 12 months ahead: $3,498.71, that leaves a favorable route to Google in the market, possible, higher than 37%.

If we look at Apple we see that it also improves the expectation of the analysts on the value. We are talking about 29 analysts who cover it, with 24 of them betting on buying the shares of the apple company in the market and 5 more who are betting on keeping their titles in their portfolio. As for the target price, it advances to 193.32 dollars per share from 181.40 that they recorded on average a month ago and the expectation of their potential as well, with foreseeable advances of 23.63%.

Already in the case of Netflix, the appreciation on the stock’s price target to $512.45 from $519.22 of the target average price that it marked a month ago, although the bullish sentiment reaches 89% in the case of Netflix by experts, while its potential upside is over 39%.

All this, you know in the midst of this difficult year for the markets and in which the absolute queen, at least for now, continues to be volatility, now seasoned by the Russian invasion of Ukraine.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.