The investment in consumer, energy and rail businesses boosted the Profits from Berkshire Hathaway in a eleven% at last trimester thanks to one growing economygetting net earnings of 90 billion dollars for 2021 according to Justin Baer in The Wall Street Journal.

Berkshire owns the 5.6% Applea share valued at $161.2 billion at the end of the year, more than 40,000 million dollars more than the previous year.

Buffett, who has warned his investors to pay little attention to investment returns, called Apple’s investment one of the “four giants” of Berkshire in its annual letter to shareholders.

The operating profitwhich exclude some investment results, increased by 45% to $7.29 billion in the quarter from $5 billion a year ago.

“Apple’s involvement is recognition of another growth pillar at Berkshire,” he said. Cathy Siefert, Analyst at CFRA Research. “Technology is now an important part of Berkshire. Who would have thought?”

Bill Smead, whose money management company owns Berkshire stocksaid he is concerned that the recognition be a sign that the conglomerate will hold on to its stake in Apple for too long, as it did with its Coca-Cola shares.

“The law of large numbers is starting to get in the way,” Smead noted. “Who is left to buy the shares? Apple is a wonderful company. Coke is wonderful. It just got too big and was overpowered.”

Buffett’s letter celebrated the Berkshire Railroad (“the number one artery of American commerce”) and the green credentials (“the company has been making climate-conscious moves for a long time”) from its power divisionwhich invests in renewable energy but they also operate with coal-fired power plants.

Buffett’s contributions to the US economy

Buffett also reminded shareholders of the large berkshire tax bill (the “invisible and often unacknowledged financial partnership between government and corporate America”). He wrote that Berkshire pays the US Treasury about $9 million a day in income taxes. Those tax payments reflect the steady company growth over many decadesa successful career, Buffett wrote, made possible by Berkshire’s US headquarters.

What did the shareholders get?

The net earnings Berkshire’s fourth quarter attributed to shareholders increased to $39.65 billion, or $26,690 per Class A share equivalent, from $35.84 billion, or $23,015 per share, in the same period a year ago.

Over one operating basewon $3.27 per Class B share equivalent in the fourth quarter, analysts said. That beat the average analyst estimate of $2.95 a share, according to S&P Global Market Intelligence.

For him Whole yearreported $89.8 billion in net earnings attributable to shareholdersof which $62.34 billion was investment gains. In 2020, investment earnings were $31.59 billion.

The Berkshire Railway

The Berkshire Railroad, Burlington Northern Santa Fereported record profits in 2021. “BNSF trains carried 535 million tons of cargo last yearmore than any other carrier,” Buffett wrote.

Berkshire said the BNSF operating income from consumer productsthe largest category of cargo it carries, rose by 13.7% in 2021. He attributed the growth to higher retail sales and e-commerce sales.

Berkshire also owns industrial manufacturers, retailers and car dealers. Many of those companies posted higher revenues last year, reflecting the economy’s broad recovery from the Covid-19 disruption.

“It’s a total bet on the American economy,” Smead said. “Operating performance was really fantastic.”

“Let us take as an example Nebraska Furniture Mart, the home furnishings retailer that Berkshire controls,” Smead said. “Think of how well they did with people who bought houses who had never bought houses before.”

A change in accounting rules in recent years has meant that Berkshire’s earnings often reflect the better stock market performancewhile Buffett has said that operating earnings more accurately reflect business operations of the company.

Comparing the numbers

The S&P 500 went up a 27% in 2021, the index’s third consecutive year of double-digit growth. On a basis of overall yieldwhich includes dividends, the benchmark index posted a gain of 28.7%. Berkshire shares outperformed it, with an annualized total return of 29%.

The Class A shares closed on friday 479,345 dollars, 5.5% more in the year. The class B shareswhich have risen 6.1% in 2022, closed on Friday at $319.24.

The company produced 20% annualized earnings between 1965 and 2020surpassing the gains of 10.2% of the S&P 500, including dividends. In recent years, Berkshire’s performance has declined. The annualized total returns of the company in the last five years were around 13%compared to the 18% of the S&P 500.

Berkshire did not make any major acquisitions in 2021, although the company remains an active buyer of its own shares. Spending $51.7 billion in buybacks over the past two yearsBuffett wrote in his annual letter to shareholders.

“Periodically, as alternative paths become unattractive, buybacks make sense for Berkshire owners,” Buffett noted. The firm spent $6.9 billion in repurchases during the fourth quarter. “As of February 23, Berkshire had spent another $1.2 billion in buybacks in 2022”.

The company ended 2021 with $146.7 billion in cashequivalents of cash and short-term treasury bills.

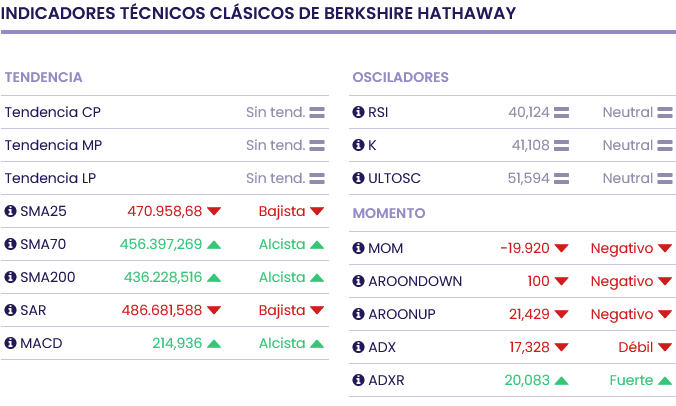

Berkshire Hathaway It closed on the last Friday of the month at $319.24 and Ei indicators are mixed.