Inditex continues to fall in double digits in the market, while losing positions also in the last month with cuts that are already costing it, in market capitalization more than 11,000 million euros in this 2022. The sector is not at its best with a winter that is less cold than expected, even warm and without rain, and a stock market environment that is not favorable, clearly marked by volatility.

To all this, In addition, there is the situation in Ukraine where the firm has a more than relevant presence, like other Spanish textile firms. There, with almost 80 stores of all its brands, especially Pull & Bear and Bershka, which has increased during 2021 with more openings. Now it is affected by Russia’s warmongering escalation, which has begun with the pro-Russian republics on Ukrainian territory and is raising geopolitical tensions in the area.

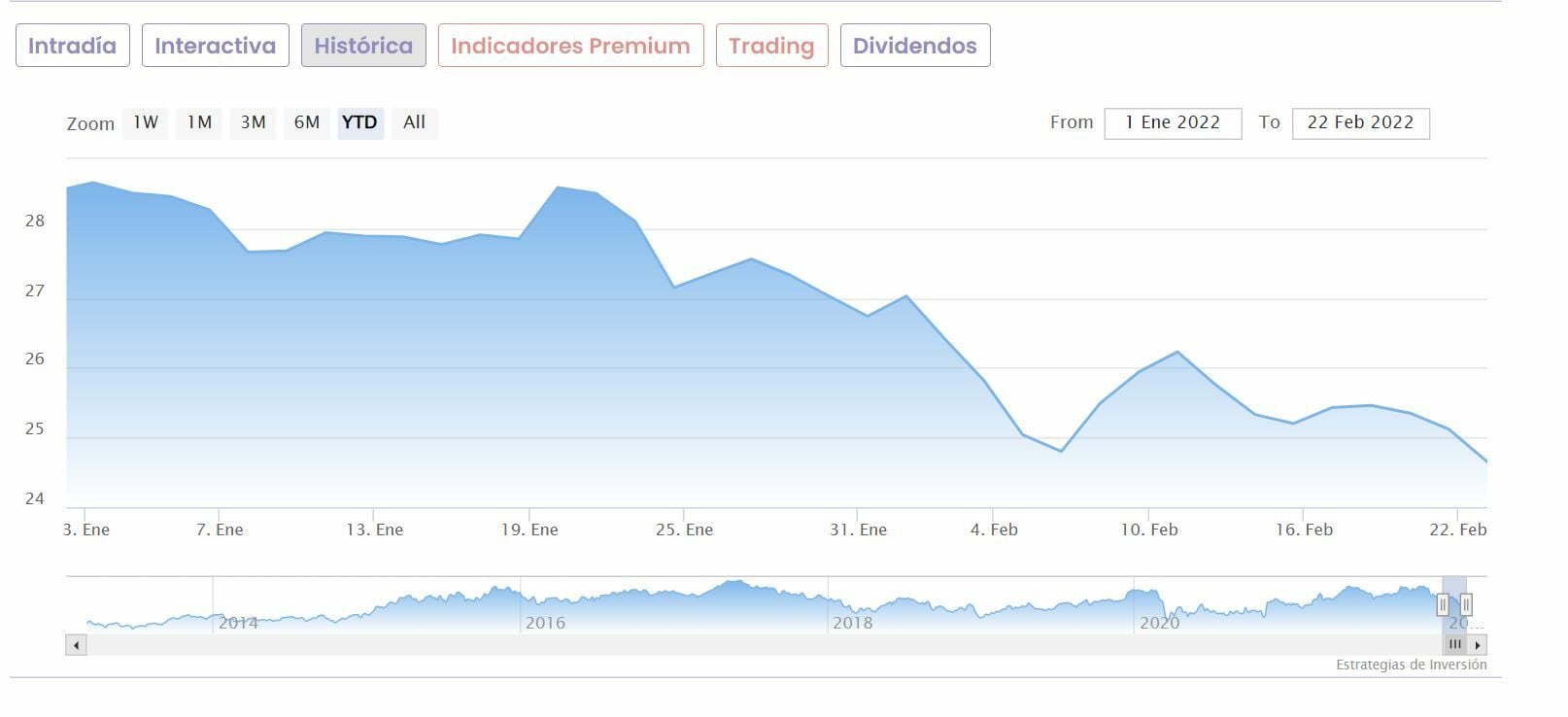

In its price graph we see that the value recovers positions after the consecutive falls of the two previous sessions and the cut that is already shown, in double digits in the last 20 sessions, with falls of 10.55% specifically for the value. It also highlights that, in this downward trend, that accumulates in the year falls of 12.5% its capitalization losses as the largest in the market falls to 11,100 million euros.

while from RBC Capital Markets it is indicated that the market penalty does not reflect the momentum of the company, therefore, he advises overweighting the value with a target price of 32 euros per share. That gives it, from its current price levels, a potential 30% hike.

For the time being, Inditex will form part of a great gear that the sector already calls as its own PERTE for the reactivation, since they have insistently demanded it from the government, and in which only the Minister of Industry, Reyes Maroto, has spoken in recent days, noting that there is room for a PERTE for the sector without further explanation. For now, they have got to work, with Inditex at the helm to sign an investment of 10,000 million private and 4,000 public through European funds.

The idea is to imply that seems to be taking place throughout the sector to reactivate the battered demand, due to the lack of mobility in which a good part of the associations seems to be involved and the SMEs that make up the majority of the sector, heavily hit by the pandemic crisis.

In addition, the firm, for the sake of digitization that it is implementing has begun to allow in the online stores of three of its banners Massimo Dutti, Oysho and Stradivarius payment with Bizum, to further facilitate the firm’s online purchases.

Inditex “manages to react in the zone of the long-term bullish guideline in fuchsia, generating two gaps in the support area, where an island gap could form, which leaves us with a minimum to work on at the height of 24.71 euros per share. The next relevant support is located at 23.78 euros per share. Exceeding the last decreasing maximum 26.59 euroswould represent a sign of strength in the face of a possible recovery of the underlying upward trend”, according to the independent analyst Néstor Borrás.

Inditex on daily chart with Average Amplitude Range in percentage, MACD oscillator and trading volume

Thus, the premium technical indicators for Investment Strategies show us that Inditex is moving downwards with barely 1 point out of 10 totals for value. Proof of this is that only the volume of business in the medium term for Inditex, which is growing, is positive.

The rest, clearly negative while standing out the trend in its two aspects, both in the medium and long term, which is bearish for the value, with negative total momentum, slow and fast, business volume decreasing in the long term to which volatility is added, its amplitude range which is also increasing in the medium and long term.

If you want to know the most bullish values of the stock market, register for free in Investment Strategies.