Roku-A presented 4th quarter 2021 results last Friday and these fell short of Wall Street forecasts. This would be the 2nd time that the firm has not achieved it since its IPO in 2017. This drop in the 22% I take the value to early 2020 levelsbefore the start of the pandemic according to Dan Gallagher at The Wall Street Journal.

The firm reported income from865.3 million dollarsabout 20 million dollars lessThat’s the lower end of the projected range of earnings for the company itself. Roku says that the supply chain crisis has so disrupted the availability of your hardware (partner-made streaming boxes and connected TVs) such as advertising in certain segments who are also affected by that shortage.

That shortage is not expected to abate any time soon.

Roku projected a 25% year-over-year revenue growth for the current quarter, which would be the slowest in almost five years. furthermore wait significantly increase spending this year to invest more in your business, which now includes original content production. As a result, he projected that the earnings before taxes adjusted for this year would be “more or less in line” with the 2020 levela drop of about 70% compared to last year.

In a market that has become brutal for richly valued tech companies, investing in growth over earnings has not gone down well.

“In essence, Roku is going to grow revenue at a slower pace than expected in combination with a massive increase in spending, which could lead to a global economic slowdown with increasing levels of competition,” he wrote. Jeff Wlodarczak of Pivotal Research Groupwho downgraded Roku’s stock to a sale rating on Friday. Even the most positive analysts were taken aback; Wedbush’s Michael Pachter maintained its rating superior performancebut rated the earnings guide for the whole year as “shocking” and predicted that the stock “would remain in the penalty box with investors for some time.

Roku also has to deal with a market that has become decidedly less friendly to streaming companies. Netflix and Spotify they have lost more than a third of their value since the beginning of the year, in part due to disappointing subscriber growth projections. AND Paramount Globalthe company once known as ViacomCBS, has lost more than a fifth of its value since its analyst meeting last week, where the company sharply increased its projected spending on streaming content for years to come.

Roku ended 2021 with around 52% of connected TV users in the US marketaccording eMarketer. But the competition is increasing. Roku’s participation in the device sales through Amazon, Best Buy, Target and Walmart it fell 18 percentage points in 2021while Amazon’s share of its products FireTV increase 16 pointsaccording YipitDatawhich tracks US streaming TV and device sales.

And because Roku is such an important platform in its own right, it no longer has the benefit of being perceived as a Neutral ground in turf battles between tech giants much larger; Lately, the company has had a few battles of its own with companies ranging from WarnerMedia, owner of HBO Max, and Google’s YouTube.

Such challenges come with the territory of having a commanding position on the TV broadcast. But growing pains were much easier to bear when growth wasn’t so expensive.

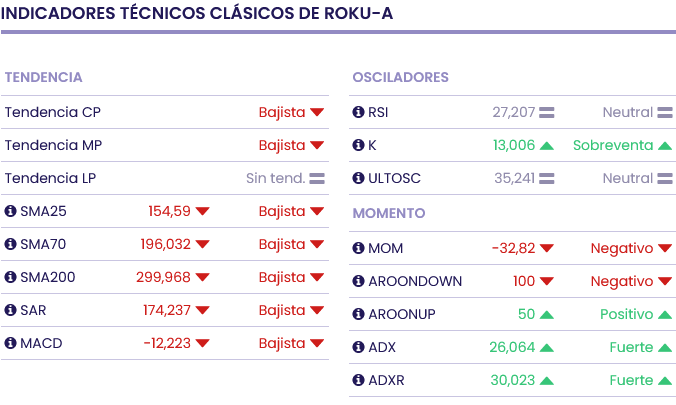

Roku-A It is trading on the last Tuesday of the month at $125.11 and the location of the moving averages, the 70-period one below the 200-period one, would give us a bearish signal. While most of the Ei indicators are bearish.