The price of Bitcoin (BTC) a new week begins in a strange place … one that is eerily similar to where it was at this time last year.

After what various sources have described as a full twelve months of “consolidation”, The BTC / USD pair is around $ 42,000, almost exactly where it was in the second week of January 2021.

The ups and downs in the middle have been significant, but essentially, Bitcoin remains in the middle of a now-familiar range.

The picture varies depending on the perspective: some believe new all-time highs are more than possible this year, while others call for many more months of consolidation.

With sentiment surrounding cryptocurrencies at some of their lowest levels ever, Cointelegraph takes a look at what could change the status quo in the near term in the coming days.

Will the $ 40,700 level hold?

Bitcoin had a tough weekend as The latest in a series of abrupt moves to the downside saw the cryptocurrency approach support at $ 40,000.

The data from Cointelegraph Markets Pro Y TradingView showed that The BTC / USD pair hit $ 40,700 on major exchanges before rebounding, a correction that has held since then.

Ironically, it was that same level that was in the spotlight on the same day in 2021, which nevertheless came during what turned out to be the most vertical phase of Bitcoin’s recent bull run.

The month of September also returned focus to the $ 40,700 level, which acted as a turning point after several weeks of correction. and ultimately saw the BTC / USD pair rose to the all-time highs of $ 69,000.

Now however the chances of a slide toward the $ 30,000 area are greater among analysts.

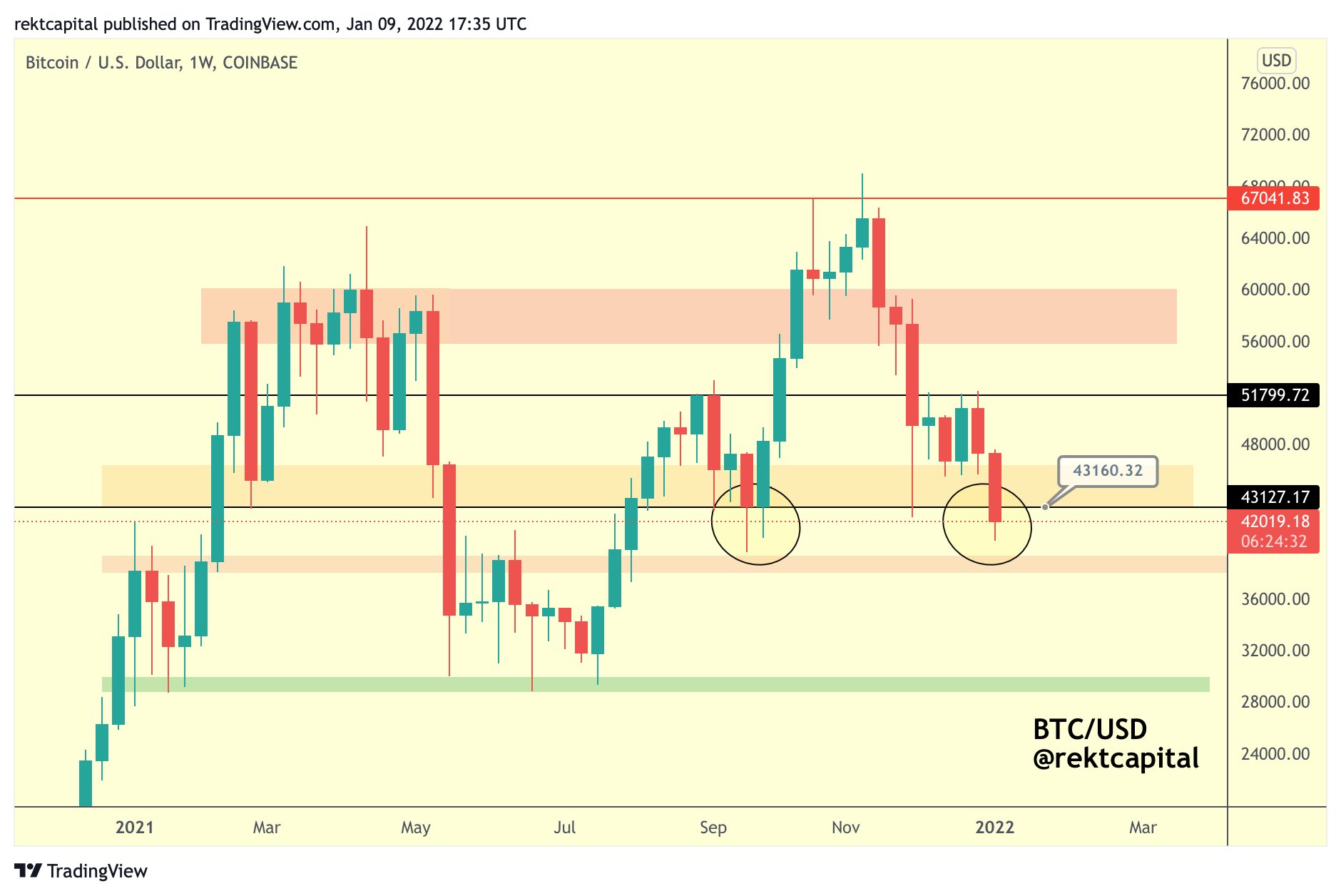

“The weekly closing is just around the corner”, summarized Rekt Capital next to a chart with target levels.

“Theoretically, there is a possibility that BTC will make a Weekly Close above ~ $ 43,200 (black) to enjoy a green week next week. However, if the weekly close falls below ~ $ 43,200, BTC could revisit the red zone below. ”

Bitcoin finally closed at $ 42,000, hovering around that level in what could prove temporary relief for the bulls.

“I think the market puts a lower high”, forecast fellow analyst Pentoshi, adding that he believes the $ 40,700 level will eventually fall.

Meanwhile, An increasingly attractive target is at last summer’s $ 30,000 low.

A consensus forms around the dire prospects for cash

The macro picture this week is especially difficult for risk-asset buffs, and Bitcoin and altcoins are no exception.

Nevertheless, what the future holds varies considerably from expert to expert.

It is generally seen that the US Federal Reserve will start to raise interest rates in the coming months, causing investors to reduce risk and causing crypto bulls a headache. The “easy money”, which began to flow in March 2020, will now be much more difficult to come by.

The bearish view was summed up by former BitMEX CEO Arthur Hayes in his latest blog post last week.

“Let’s forget what non-crypto investors believe; my take on crypto investor sentiment is that they naively believe that the fundamentals of network and user growth across the complex will allow crypto assets to continue their upward trajectory unabated, “he wrote.

“To me, this presents the setup for severe laundering, as the detrimental effects of rising interest rates on future cash flows will likely prompt speculators and investors on the margin to divest or severely reduce their crypto holdings. . “

This week the data of the consumer price index (CPI) of the United States corresponding to December are published figures that will probably feed the story of the surprising rise in inflation.

Hayes isn’t the only one worrying about what the Federal Reserve may bring to crypto this year, and Pentoshi, among others, has also announced the temporary end of the bull run.

“And the final question is, can the crypto space ignore the Fed if it decides to go all out brandishing a deflationary machete? I doubt it,” concluded analyst Alex Krueger. in a series of tweets on the subject this weekend.

“” Don’t Fight the Fed ‘applies both ways, up and down. If the Fed is * too extreme * then Houston, we have a problem. “

There were some optimists in the room. Dan Tapiero, founder and CEO of 10T Holdings, told fans to “ignore” the recent drop and focus on a long-term investment opportunity unchanged.

“The most bullish macroeconomic backdrop of the last 75 years”, He said.

Booming economy supported by massive negative real rates. The Fed will never match rates with inflation. They are long on stocks and on Bitcoin and ETH. Do holding through short-term volatility. Cash savings in real dollars will continue to lose value. “

Here’s a look at the Effective Fed Funds Rate and Inflation Rates when the Unemployment Rate was at 3.9%, as it is today.

Find the outlier …

– Charlie Bilello (@charliebilello)

Here’s a look at the Effective Fed Funds Rate and Inflation Rates when the Unemployment Rate was at 3.9%, as it is today. Find the outlier …

Tapiero highlighted data compiled by Charlie Bilello, founder, and CEO of Compound Capital Advisors.

RSI hits two-year lows

Amid pessimism, not everything points to a prolonged bearish phase for Bitcoin specifically.

As Cointelegraph has reported, On-chain indicators are calling for increases en masse, and the historical context serves to support those demands.

This week, It is Bitcoin’s Relative Strength Index (RSI) that continues to hold, hitting its lowest levels in two years.

#Bitcoin RSI has been this low just 2 other times in the last 2 years. Looks like a bottom is near and bounce due.

– Bitcoin Archive (@BTC_Archive)

Bitcoin’s RSI has been as low only 2 other times in the last 2 years. It looks like a bottom is close and the rebound should follow soon. We’ll see.

RSI is a key metric used to determine whether an asset is “overbought” or “oversold” at a certain price point.

The fact of sinking the depths by $ 42,000 suggests that that level is considered too extreme by the market, and there should be a rebound to balance it out.

Conversely, Last January, the RSI was through the roof and, conversely, well within “overbought” territory, while the BTC / USD pair was trading at the same price.

“Bitcoin’s RSI is at the lowest point in 2 years on the daily. March 2020 and May 2021 were the last. And people go bearish here / want to go short“, commented hopeful a Cointelegraph contributor, Michaël van de Poppe.

Cointelegraph saw similar bullish signs on the RSI monthly chart last week.

Hash index recovers from losses in Kazakhstan

Another problem from last week that is already “healing” comes from the realm of Bitcoin fundamentals.

After hitting new all-time highs over the past few weeks, The hash rate of the Bitcoin network took a hit when the turmoil in Kazakhstan affected the availability of the internet.

Kazakhstan, which is home to around 18% of the hash rate, has since stabilized, allowing the hash rate to come back to the above levels of 192 exahashes per second (EH / s).

At one point it dropped to 171 EH / s, causing unrest in the market. The responses to what may remind some of China’s mining ban last May to appear to have raised the hash rate and preserved the miners’ participation record.

The Bitcoin network difficulty despite the turmoil still managed to put in a modest increase this weekend and is currently on track to do so again. on your next automated reset in just under two weeks.

“Always going up”, commented on-chain analyst Dylan LeClair about the classic mantra “price follows hash rate”.

To contextualize, China’s mining defeat caused the hashing rate to drop by 50%. It took about six months to recoup the losses.

“What if …?”

Someone who has been saying for a long time that it is time for a trend change in the price of Bitcoin to take place is the quantitative analyst PlanB, creator of the stock-to-flow-based BTC pricing models.

Nowadays, PlanB is in the test of its creations – and the ensuing storm of criticism on social media – but remains more optimistic than most when it comes to medium and long-term price action.

“I know some people have lost faith in this bull market for bitcoin”, recognized this weekend.

“However, we are only in the middle of the cycle (2020-2024). And although BTC experiences some turmoil in Q1, and I think the yellow gold pool at S2F60 / $ 10T (small black dots are gold data from 2009-2021) is still the target. ”

He was referring to the stock-to-flow value for Bitcoin, gold, and other assets as part of his stock-to-flow cross-asset (S2FX) model, which predicts an average price of the BTC / USD pair of $ 288,000. during the current halving cycle.

Nevertheless, A more simplified comparison between this cycle’s Bitcoin price and it’s previous two saw a feasible trajectory that starts with a U-turn now.

– PlanB (@ 100trillionUSD)

Another model, that of the floor, which demanded a price of USD 135,000 per bitcoin by the end of December, has been discarded after failing to reach its goal for the first time in November.