Key facts:

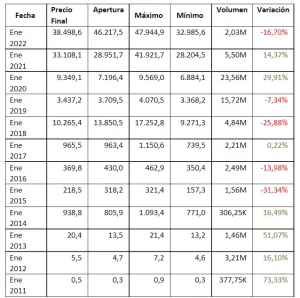

- Since 2011, the price of bitcoin has closed the month of January down 5 times.

- In 2018, the year in which the so-called “crypto winter” began, bitcoin fell almost 26%, in dollars.

The valuation of bitcoin (BTC) in US dollars closed January 2022 with its worst drop since 2018. The price of the cryptocurrency lost 16.7%, and tested lows below USD 33,000, in its worst January in 4 years.

According to Historical records from Investing.com, since January 2018, the year of the prolonged bear market (bear market) baptized as “crypto winter”, a higher fall has not been seen. In that year the price was reduced by 25.88% per BTC.

January 2022 marked just 12 days in green numbers for the bitcoin price, Bloomberg said. The fluctuations took its valuation to lows of USD 32,985, around 52% below its all-time high of USD 69,000, reached in November 2021. The final price of the period recovered slightly to close the first month of the year around USD 38,500.

Advertising

As CriptoNoticias reported, this year began with news that impacted the asset markets and sparked selloffs in risky assets, including bitcoin. Among them, is the possible increase in interest rates by the US central bank (FED). Additionally, there were massive power outages in Kazakhstan, the second country with the highest concentration of Bitcoin hash rate worldwide.

However, the issue generated other cuts in the price of bitcoin, taking it to its low for the month, on the eve of the meeting of the US authority to set the new interest rates. However, the expected announcement did not take place and the bitcoin market responded with an 18% rebound.

One of the signs of the month was the increased correlation between bitcoin and traditional markets. The correspondence between the movements of the cryptocurrency and the Nasdaq indices reached a coefficient of 0.66 for the first time. The correlation between bitcoin and the S&P 500 also hit all-time highs in January.

Price could continue to recover, according to analysts

However, analysts such as Willy Woo believe in the possibility of a recovery in the price of bitcoin, since the fall in January is not supported by the fundamentals that are evident in the network.

- In this sense, at the end of the month, the most volume of BTC was registered in the exchanges of the last three years, which is interpreted as an intention of investors not to sell their bitcoin holdings. Conversely, traders seem to be buying and stockpiling BTC at a discount, on the early 2022 dip.

At the time of writing this report, bitcoin is trading at USD 38,650.37, according to the CriptoNoticias calculator.