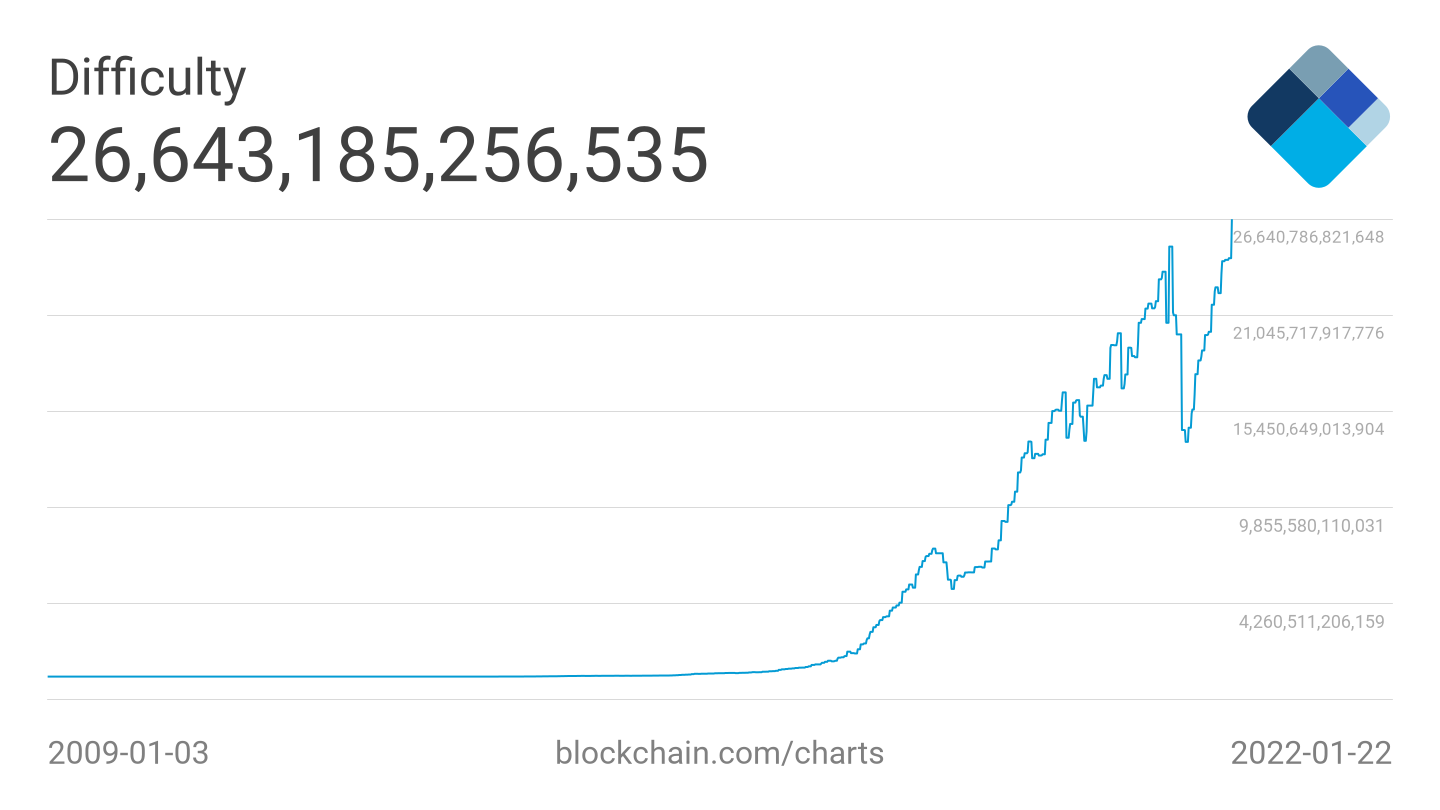

The Bitcoin (BTC) network has recorded a new mining difficulty all-time high of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s), indicating strong community support despite a bear market.

The difficulty of the Bitcoin network is determined by global computing power, which correlates with the difficulty of confirming transactions and mining BTC. What shows blockchain.com data, the difficulty of the network experienced a decrease between May and July 2021 due to various reasons, such as the General ban on cryptocurrency mining in China.

Nevertheless, when displaced miners resumed operations from other countries, network difficulty saw a dramatic recovery since August 2021. As a result, on Saturday, the Bitcoin network recorded an all-time high of 26.643 billion.

BTC.com data estimate that the network will continue to strengthen reaching another all-time high in the next 12 days, with a network difficulty of 26.70 billion.

Over the past four days, F2Pool has been the largest hash rate contributor by mining 88 BTC blocks, followed by Poolin with 76 blocks. As of yesterday, the average fee per transaction is approximately $1.58, a value that historically peaked at $62.78 in April 2021.

Despite federal pressure for tighter monetary policies around cryptocurrencies, Bloomberg Commodity Strategist Mike McGlone suggests that bitcoin has a fighting chance to come out ahead as investors recognize its value as a digital reserve asset.

As Cointelegraph reported, McGlone believes that bitcoin is uniquely positioned to outperform in an environment where easing stimulus is often seen as a negative for risk assets:

“Cryptocurrencies are at the top of risky and speculative assets. If risky assets decline, it helps the Fed fight inflation. By becoming a global reserve asset, bitcoin may be a primary beneficiary in that stage”.

Keep reading: