Sustainable investments move in historical records. Even in episodes with high upheaval and volatility, such as those that happened in 2020 and 2021. When not a few analysts and market agents rushed to classify portfolios under ESG criteria as bubbles about which only assets seduced by risk were willing to fasten seat belts. Nothing could be further from the truth. In both years, assets with ESG investment principles have exceeded 35 billion dollars each year. A amount almost as high as the sum of the two largest economies on the planet -USA and China- and just over a third of world GDP.

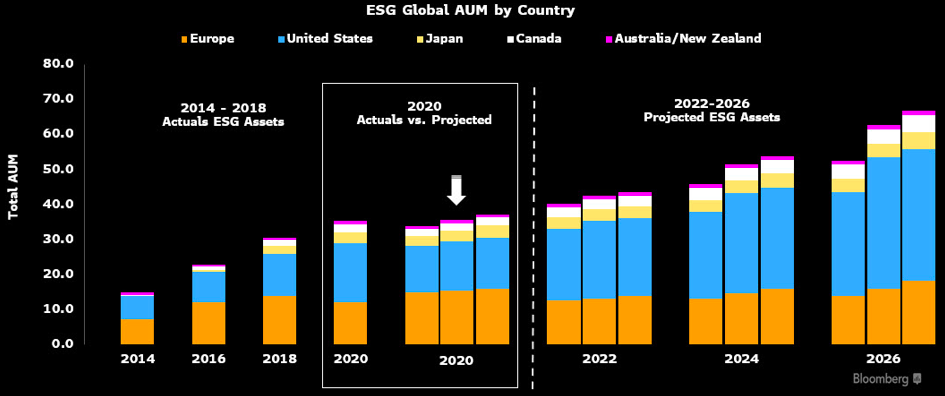

ESG investor fervor doesn’t seem like a flash in the pan either. Quite the contrary, they seem to be here to stay. Judging by the predictions of Bloomberg Intelligence, whose experts estimate that its assets will exceed the psychological barrier of 50 trillion in 2025. The equator of the great race towards energy neutrality, which has in 2030 the first and most transcendental of its flying goals , will be a turning point, given the growing demand for capital to place in these assets in view of the growing social concern for environmental issues.

In its predictive analysis, Bloomberg Intelligence places the value of ESG assets at the end of this year at 41 trillion dollars. Driven by growth in the US, after, in the last biennium, the leading role was taken by the European markets. “It will be like a return from the periphery to the Gordian core of the markets, Wall Street,” they explain. To the point that assets linked to ESG actions will account for one out of every three dollars invested in the international financial architecture. Historically, this investment fever has been localized in recent years in Europe, but it will spread throughout all latitudes, industrialized and emerging and developing, warns, in support of calculations by Bloomberg Intelligence, the forum that acts as employer of this industry, the Global Sustainable Investment Association. Although there is also skepticism about the effective consolidation of these assets.

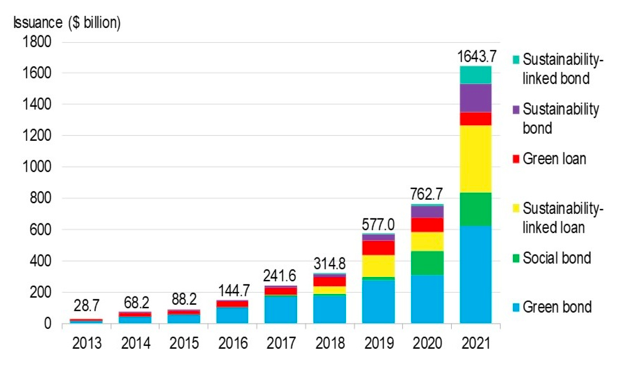

However, one of the aspects that reflects the initial solidity of these investments is in debt management. Because the volume of annual sustainable bond issuance exceeded $1.6 trillion in 2021, with more than 4 trillion transactions since its launch in the markets, which shows that, more than a phenomenon, as it was cataloged at the beginning of its journey, they are an increasingly common reference among debt investors. Especially fixed income.

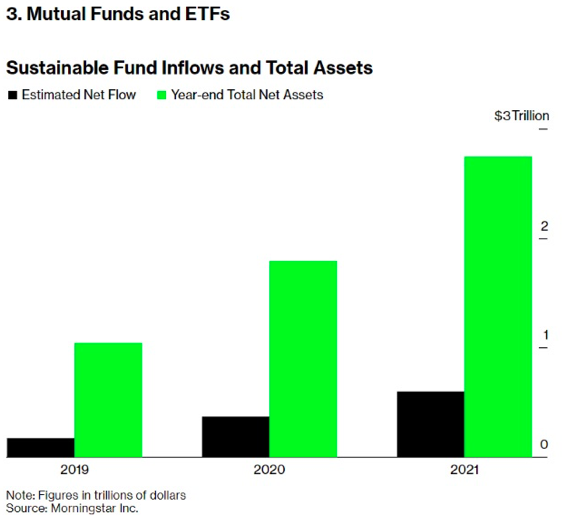

Also your leading role within the mutual funds, where capitals with an ESG seal have been stable. Until reaching 53% of the 2.7 trillion dollars of its global investment portfolios, with a strategic net flow of 596,000 million dollars, according to data from Morningstart. Information that takes into account the momentous accounting review in Europe, where regulatory bodies imposed strict standards to define the classification of a sustainable fund. The new rules of the game meant that more than a thousand funds left the universe of sustainability, as the market research firm admits. Although, as he immediately warns, it also led to the massive entry of new managing agents.

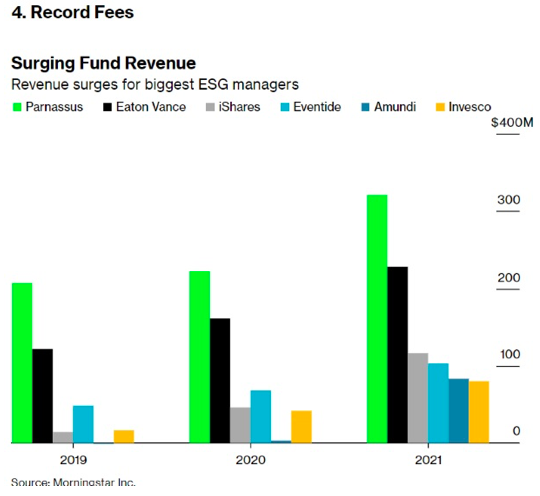

Another relevant indicator that emerges from the ESG investment segment has been the record that, in 2021, its managers have obtained for professional rates. Worldwide, entities in the asset management industry hoarded $1.8 billion, up from $1.1 billion in 2020. Also according to data from Morningstar, which records historical asset management returns. With especially lucrative rates. With Parnassus Investments commanding the rewards, with more than 320.7 million dollars in fees. A year of prosperity in which notable business operations were forged. Since the purchase by the Affiliated Managers Group of several San Francisco firms specializing in ESG. Or the 227.7 million professional remunerations of Eaton Vance, Morgan Stanley’s armed investment arm in this type of asset after acquiring one of the most classic ESG firms Calvert and the also exceptional 116.5 million distributed among its managers with funds by iShares, BlackRock’s ESG unit.

However, the investment horizon in ESG assets is not entirely clear. Some discouragement is beginning to spread among the CEOs of the largest multinationals regarding the achievement of energy neutrality objectives. Only 40% of them consider that the challenge of achieving net zero CO2 emissions will be met by the halfway point of the century. As revealed by a survey by the New Climate Institute and Carbon Market Watch. In a recent joint study, these two non-profit institutions found that only 25 of the world’s largest companies have really implemented forceful and effective measures to certify their zero emissions and only 3 – the shipping company Moller-Maersk and the operators Vodafone and Deutsche Telekom- “have established clear strategic commitments to decarbonize at least 90% of their entire value chain.”

In this context, its experts claim “more ambitious international concerted actions to achieve, in the medium term, the objectives of the Paris Agreements for 2030”, the only formula with prospects of success in the fight against climate change. Even with legal requirements to reduce the size of corporations and facilitate sustainable roadmaps. Or through prohibitions on deforestation or non-permanent use of coal and other highly polluting fuels. The regulatory capacity of governments and the power of investors to galvanize environmentally sustainable capital is essential to drive all the technological and corporate changes needed to reverse climate catastrophe. Because at least 5 of the largest multinationals hardly recognize efforts to cut their current CO2 emissions by less than 15% and 12 of them do not even have any official commitment to address this challenge in 2022.

In the same way, the banks, in their purpose of formalize green finance, raise their entry places and their credentials in credit certification and financing lines towards sustainable companies, while they continue to formalize most of their loans with emporiums and firms that, like most of the oil supermajors, maintain their commitment to fossil fuels. Wells Fargo, Citigroup and Morgan Stanley are good examples of this, despite the fact that they have just received the MSCI award, the American certification firm for private equity funds. The three financial entities granted more than 74,000 million dollars in 2021 to highly polluting companies.